The merger between UniCredit Bank S.A. and Alpha Bank România S.A. has been successfully completed, marking a major milestone for Italy’s UniCredit Group in Eastern Europe. The combined entity now holds 11% market share in assets, 13% in loans, and 11% in deposits, positioning it as Romania’s third-largest banking group.

With a network of 300 branches and 900 ATMs, the new UniCredit Bank offers broader access to financial services across the country. Its 4,800 employees, including Alpha Bank’s staff, will serve both corporate and retail clients with enhanced solutions and banking technology.

Andrea Orcel, CEO of UniCredit Group, underlined the strategic importance of the deal:

“This acquisition and merger of Alpha Bank Romania enables UniCredit to strengthen its market position and unlock new potential for accelerated, profitable growth, both for us and for our customers. Alpha’s long-standing presence in Romania, that continues via its maintaining a 9.9% stake in UniCredit Bank Romania, reinforces our strategic role in Eastern Europe, a region in continuous development.”

Mihaela Lupu, CEO of UniCredit Bank in Romania, highlighted the local significance:

Mihaela Lupu, CEO of UniCredit Bank in Romania (Image Credit Mihaela Lupu official LinkedIn account)

“By completing the merger, we become a stronger bank and better positioned for the future. We were delighted that there was a very good energy between our teams, and we complemented each other, managing to become one bank in just 9 months.”

Strategic significance and financial impact

The transaction involved UniCredit S.p.A. acquiring 90.1% of Alpha Bank Romania for €255 million in cash plus 9.9% of UniCredit Romania’s capital. Alpha retains its 9.9% stake, reinforcing the long-term partnership between the two institutions, first announced in October 2023.

Clifford Chance Badea advised UniCredit on the deal, coordinating a multidisciplinary team led by Managing Partner Daniel Badea and specialists in corporate, banking, and finance law.

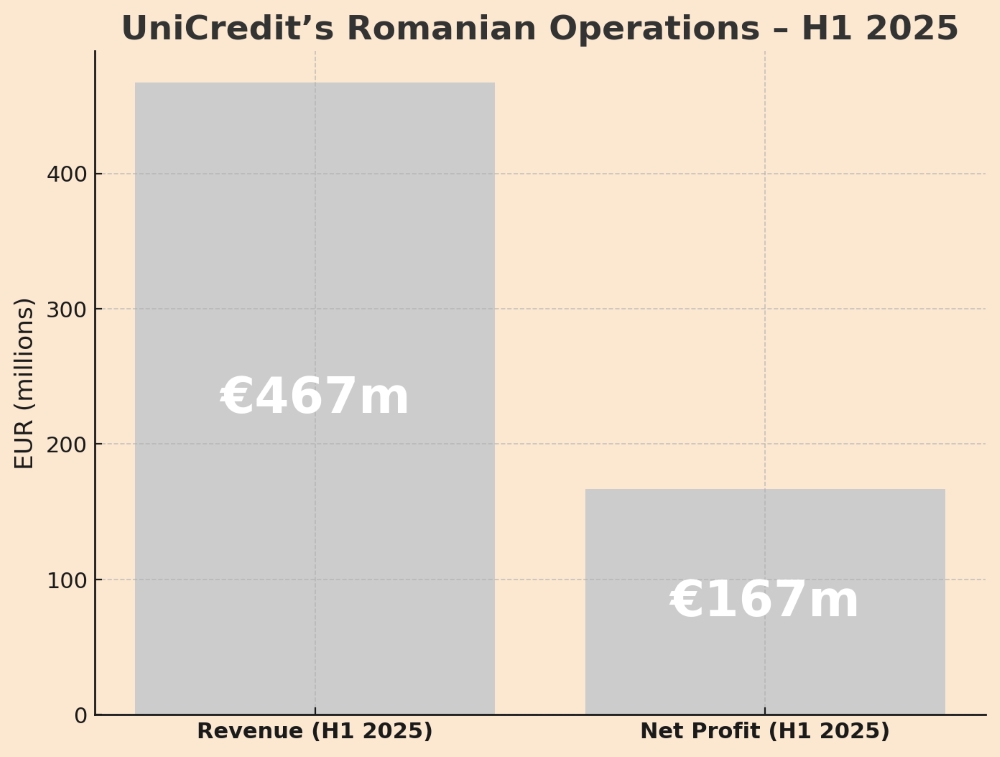

Financially, UniCredit’s Romanian operations are already showing momentum, with €467 million in revenue in the first half of 2025 (+38% year-on-year) and a net profit of €167 million. Moody’s recently upgraded UniCredit’s outlook to positive, reaffirming its Baa1 rating above the sovereign.

On a group level, UniCredit reported €3.3 billion net profit in Q2 2025 and €6.1 billion in the first half, raising its full-year profit guidance to €10.5 billion. The bank also lifted its revenue outlook and return-on-equity targets, underscoring confidence in sustainable growth.

Meanwhile, Alpha Bank Greece, where UniCredit now holds a 20% stake, reported €459.9 million normalized net earnings for the first half of 2025, supported by higher fee income and credit expansion. Its non-performing loan ratio improved to 3.4%, down from 3.7% in 2024, reflecting stronger asset quality.