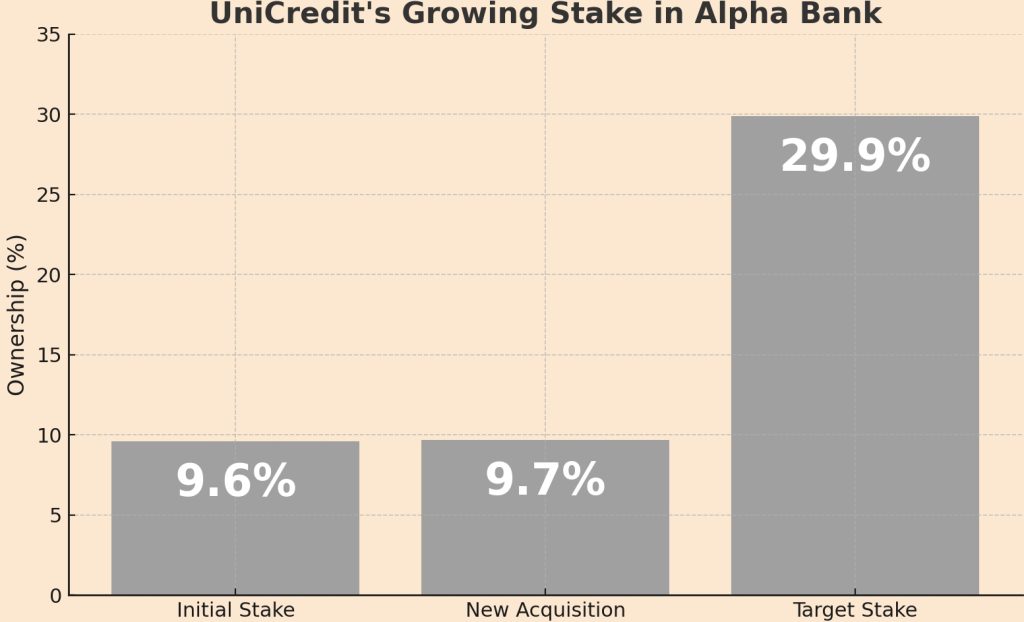

In a significant move underscoring its long-term commitment to Greece’s banking sector, Milan-based UniCredit has agreed to acquire an additional ~9.7% stake in Alpha Bank, parent company Alpha Services and Holdings S.A., for around €615 million, according to a Bloomberg report. This follows UniCredit’s existing 9.6% stake and will bring its total ownership to approximately 20%, allowing for equity consolidation and deeper integration of the two institutions.

Physical settlement of the transaction is subject to regulatory approvals, which UniCredit expects to obtain in due course. Once completed, the bank plans to submit all necessary filings to hold a stake in Alpha of up to 29.9%.

The increased ownership will allow UniCredit to consolidate Alpha’s financial results into its own, a move expected to enhance earnings visibility and unlock additional synergies. The transaction is projected to generate an extra €180 million in annual net profit, which will be returned to shareholders in line with UniCredit’s distribution policy.

A positive outlook for returns and capital

The deal, expected to close by the end of 2025, will temporarily reduce UniCredit’s CET1 capital ratio by about 40 basis points. However, the bank anticipates a return on investment of roughly 16% annually—or 19% since the inception of the original partnership—figures that could rise further as integration efforts progress.

Andrea Orcel, UniCredit Group CEO (Image credit: UniCredit Group)

“This step strengthens our successful partnership with Alpha, which has already delivered value well in excess of expectations” said Andrea Orcel, UniCredit’s CEO and former Wall Street banker, who joined the bank in 2021. “And there is much more to come. We have confidence in Alpha’s leadership, their strategy, and Greece’s growth trajectory.”

Orcel praised both Alpha’s leadership team and the Greek government for their collaborative approach, crediting strong institutional support in Athens for helping facilitate the success of the partnership so far.

A billion-euro bet on Greece

This latest investment brings UniCredit’s total spending on Alpha Bank holdings to nearly €1 billion over less than two years. In late 2023, the bank paid €293.5 million to acquire the Greek state’s remaining stake in Alpha, a deal that also included the acquisition of most of Alpha’s Romanian operations and a partnership to distribute asset management products to Alpha’s 3.5 million customers.

Alpha Bank shares closed at €2.79 per share on Tuesday, May 27—the day before the announcement.

Currently, foreign institutional investors hold around 72% of Alpha Bank, with Greek institutions owning another 7%. Individual and corporate shareholders account for the remaining 11%.

The move was warmly received by Greek authorities and market participants. Vassilios Psaltis, CEO of Alpha Bank, and Yannis Stournaras, Governor of the Bank of Greece, both hailed the transaction as a “very positive development” for Greece’s financial system and broader economy.

Looking Ahead: Commerzbank and Banco BPM Still in Play

The Alpha Bank expansion comes amid ongoing efforts by UniCredit to complete two other high-profile deals: the proposed acquisitions of Germany’s Commerzbank AG (OTC: CRZBY) and Italy’s Banco BPM SpA. Both remain pending, with regulatory hurdles still to be cleared.

Still, UniCredit remains focused on executing its broader strategy, UniCredit Unlocked: Acceleration, aimed at driving sustainable, profitable growth and delivering consistent shareholder returns.

UniCredit at Glance

Year founded: 1998 Headquarters: Milan, Italy Employees: 70,752 Revenue: €23.8 billion (2023) Stock Listing: Borsa Italiana (Ticker: UCG)

Alpha Bank at a Glance

Year founded: 1879 Headquarters: Athens, Greece Employees: Approximately 8,500 (as of 2025) Revenue: €5.5 billion (2023) Stock Listing: Athens Stock Exchange (Ticker: ALPHA)